Introduction

Against the backdrop of falling interest rates and global capital reallocation, the compliant tokenization of onshore real-world assets (RWA) in Hong Kong has evolved from a “conceptual pilot” to an “executable solution.” For Mainland asset owners, this path offers three major advantages:

- More flexible financing and monetization: Receivables, bills, energy revenues, computing power leases, equity/REITs, and other assets can be transformed into divisible, tradable digital certificates.

- Connect global capital: Leverage Hong Kong’s legal framework and licensed intermediaries to connect with offshore funds and new types of investors directly.

- Reduce operational friction: Issuance, registration, distribution, and disclosure can be programmable on-chain, enhancing transparency and trust.

This guide unfolds in a sequence of various dimensions, including regulation, assets, issuance, structures, roles, technology, and risks, providing actionable steps and checklists to help implement the first minimum viable product (MVP) within 8 to 12 weeks at the fastest.

1. Hong Kong’s Regulatory Landscape and Latest Developments

First, it is necessary to clarify the fundamental principle that “tokenization does not change the essence of assets”, so that all subsequent issuance, sales, custody, and trading can “match their positions” and find the correct and compliant path.

Tokenization does not change the asset substance: The Hong Kong Securities and Futures Commission (SFC) has made clear that tokenizing real-world assets does not change their legal nature. If the underlying asset qualifies as a security, the tokenized version is still treated as a security and must comply with existing securities laws. In essence, “tokenized securities” are traditional regulated securities wrapped in digital technology: the underlying asset remains regulated under securities law, while the token “wrapper” must also meet technical compliance requirements. Regulators apply a “substance over form” principle — same business, same risks, same rules — to prevent issuers from evading the existing legal framework under the guise of tokenization.

Key regulatory documents, 2019–2025: In March 2019, the SFC issued the “Statement on Security Token Offerings (STO Statement),” stressing that security tokens are highly likely to fall within the definition of “securities” under the Securities and Futures Ordinance (SFO). Unless exemptions apply, anyone promoting such tokens in Hong Kong must obtain a Type 1 (dealing in securities) license. The statement also reminded intermediaries that tokens should only be offered to professional investors. On November 2, 2023, the SFC issued a circular to licensed intermediaries that updated and replaced the 2019 STO Statement. It explicitly defined tokenized securities as securities that use distributed ledger technology (DLT) at any stage of issuance, trading, or settlement. These tokens remain subject to existing securities offering rules. Importantly, the SFC no longer automatically classifies tokenized securities as “complex products.” With regulatory approval, such products may in the future be offered beyond professional investors.

Stablecoin legislation timeline: At the end of 2023, the Hong Kong Monetary Authority (HKMA) launched a consultation on stablecoin regulation. In 2024, it actively drafted legislation and initiated sandbox testing. In May 2025, the Legislative Council passed the “Stablecoin Ordinance Bill,” establishing a licensing regime for fiat-backed stablecoin issuers, which came into effect on August 1, 2025. This positioned Hong Kong among the first jurisdictions with a comprehensive stablecoin regulatory framework. The ordinance requires issuers of fiat-pegged stablecoins to obtain licenses. During the transition, unlicensed issuers may only serve professional investors. Meanwhile, HKMA’s 2024 stablecoin issuer sandbox allowed qualified institutions to pilot operations and build regulatory experience.

Regulatory sandbox and innovation pilots: Hong Kong regulators have taken a proactive yet cautious stance toward tokenization. Between 2022–2023, the government pioneered tokenized bonds: In February 2023, HKMA helped the government issue the world’s first government tokenized green bond (1-year maturity, HKD 800 million), recorded on blockchain. In January 2024, it issued multi-currency digital green bonds raising around HKD 6 billion. These pilots proved Hong Kong’s legal and financial infrastructure is compatible with tokenization. Investors experienced faster settlement (T+1 or even T+0) and 24/7 operations, while regulators tested how to register, transfer, and pay interest for on-chain bonds. Best practices included starting with high-credit, low-risk assets, integrating the Central Moneymarkets Unit (CMU) with blockchain, the operational changes of market participants can be reduced. Fully disclose technical details to enhance market confidence.

The impact of the VATP licensing framework on secondary trading of RWA: Since June 2023, Hong Kong has implemented a new licensing system for virtual asset trading platforms (VATP), also known as VASP licenses, bringing virtual asset trading under the purview of anti-money laundering regulations. According to this framework, secondary market trading platforms for non-securities tokens (such as pure digital goods, physical asset tokens, etc.) must apply for and hold VASP licenses; while trading platforms or intermediaries for securities tokens (essentially securities trading) need to obtain the corresponding securities business licenses (such as Type 1 securities brokerage license or Type 7 automated trading service license). This means that when RWA projects seek secondary market liquidity, they must choose the appropriate licensed platform based on the token’s attributes: securities-type RWA can typically only be traded privately through the internal ATS systems of licensed brokers or other SFC-regulated venues; non-securities-type RWA can be listed on licensed virtual asset exchanges (currently only open to professional investors). It is important to note that the attributes of tokens may not be static – some tokens initially designed as non-securities may become securities if additional rights are granted to their holders in the future. Regulatory authorities suggest that issuers conduct dynamic evaluations and, when in doubt about the attributes, apply for comprehensive licenses in advance to ensure continuous compliance with regulations.

After clarifying the regulatory boundaries, the next step is to select appropriate assets and match them with target investors, which will directly determine the speed and scale of the project’s progress.

2. Tokenized Assets and Investor Suitability

Asset selection is the cornerstone of project success, while investor suitability ensures compliance and efficiency.

Scope of tokenizable assets: The category of real-world assets (RWA) is extremely broad, covering almost all physical and financial assets with stable value or cash flow. Currently, typical asset classes suitable for tokenization include:

- Accounts receivable and bills: Corporate accounts receivable, supply chain finance bills, commercial bills, etc. Tokenization of these short-term debts can enhance liquidity and convert future cash flows into tradable digital certificates. For instance, in August 2025, Shangao Holdings issued the first tokenized corporate accounts receivable bill in Hong Kong, with a scale of 40 million US dollars. Investors holding the token are equivalent to holding the corresponding bill claim and receive the principal and interest of the bill upon maturity.

- Bonds and loans: Including corporate bonds, government bonds, loan assets, and other fixed-income products. Tokenization of bonds can shorten settlement cycles and expand the investor base. The Hong Kong Monetary Authority has collaborated with international organizations to test the concept of tokenized green bonds and successfully issued government tokenized green bonds to verify market response (see above). Additionally, tokenization of credit assets such as non-performing loans also has the potential to release liquidity, transforming illiquid claims into tradable assets on the blockchain.

- Real estate and property rights: Commercial real estate, residential properties, land use rights, infrastructure projects, etc. Tokenization of these assets enables them to be sold in shares, lowering the threshold for individual investment. Investors holding real estate tokens obtain corresponding property rights or income rights. Special attention should be paid to issues such as property rights confirmation, valuation, and cross-border legal matters. For example, cross-border transfer of domestic real estate rights must comply with foreign exchange and foreign investment regulations. Hong Kong has seen real estate investment trusts (REITs) exploring the possibility of tokenized transactions, but currently, most are still in the concept validation or private placement stage.

- Fund shares and financial products: Securities investment funds, private equity funds, structured products, etc., can also be tokenized, meaning that fund shares can be registered and traded on the blockchain. Internationally, large asset management institutions have begun to test this: for instance, Franklin Templeton in the United States tokenized its money market fund shares and traded them on a blockchain, allowing investors to hold traditional fund shares through tokens. If such fund tokens are issued to the public in Hong Kong, they need to obtain approval from the Securities and Futures Commission (i.e., product authorization) before public offering, so currently, most are launched as pilot products for professional investors in a private placement format.

- Green assets (carbon credits, green energy certificates): Green financial assets such as carbon emission quotas and renewable energy certificates can improve market transparency and transaction efficiency through tokenization. Carbon credits themselves have quasi-public good attributes, and tokenization must comply with carbon trading regulations. Enterprises with large amounts of new energy assets (such as photovoltaic power stations, wind farms) can also tokenize future carbon reduction benefits through the Hong Kong market to achieve financing. It is important to note that different jurisdictions have different definitions of carbon asset attributes (commodities, securities, or contracts), and potential legal uncertainties should be disclosed at the time of issuance.

- Energy and computing power leasing: Emerging categories, including cross-border new energy project power generation revenue rights, as well as data center cabinets/computing power leasing and other digital infrastructure assets. The market views these as the core “hard currency” of the next-generation RWA, such as AI computing power and green energy rights. For example, a mainland enterprise issued tokenized bills for financing in Hong Kong, packaging the leasing rights of tens of thousands of IDC cabinets and renewable energy certificates into tokens, achieving the integration of the real economy and digital finance. Tokenization of such assets requires assessment of technical feasibility (such as monitoring computing power usage on the blockchain) and legal compliance (such as cross-border enforcement of power/computing power leasing contracts).

Investor Suitability: Professional Investors vs. Retail Public – In line with regulatory requirements for investor protection, RWA token projects need to consider investor classification when choosing their target audience:

- Professional Investor Path: Currently, the vast majority of onshore asset tokenization projects in Hong Kong are only available to professional investors and are financed through private placements. Hong Kong regulations provide several private placement exemptions, allowing the issuance of securities to professional investors (individual assets ≥ HKD 8 million, or institutional investors, etc.) without the need for prospectus registration. Professional investors typically have a higher risk tolerance, and regulatory review for such issuances is relatively lenient.

- Retail Public Path: Public token offerings are currently very limited and can only be conducted through products authorized by the Securities and Futures Commission (e.g., embedding tokens in mutual funds or retail bonds). Retail investor protection is strict, and issuers must meet the same disclosure and risk control requirements as traditional public offerings. Regulatory authorities are particularly cautious about any token products targeting retail investors. Currently, apart from official pilots, there are no precedents for direct public offerings of pure RWA tokens.

After identifying the assets and target audience, the project proceeds to the selection and implementation of the issuance and sales path.

3. Compliance Path for Issuance and Sales

In practice, the prevailing approach is Private Placement to Professional Investors (PI), while the retail pathway is more suitable for mature products with full licensing, strong disclosure, and substantial scale.

Private placement for professional investors (exemption framework): Most RWA token issuances choose to rely on the private placement exemption framework in Hong Kong. According to the “Companies (Winding Up and Miscellaneous Provisions) Ordinance” and Part IV of the “Securities and Futures Ordinance”, if the securities issuance is only targeted at professional investors or meets other specific conditions (such as each investment being no less than 5 million Hong Kong dollars, etc.), the pre-registration of the prospectus can be exempted. This enables the issuer to issue tokenized assets quickly through a private placement method, without going through the lengthy approval process of public offering. A typical approach is: establishing a Hong Kong SPV as the issuance entity, preparing an investment agreement or private placement statement, and non-publicly promoting to a few qualified investors. During this process, the issuer still needs to ensure adequate risk disclosure, obtain the professional investor qualification confirmation from investors, and comply with the restrictions on not publicly soliciting. The advantages of private placement are speed, flexibility, and lower costs; the disadvantages are a limited investor range, relatively limited fundraising scale and secondary liquidity.

Public offering of authorized products by the Securities and Futures Commission (retail path): If RWA tokens are to be issued to the public, the product must be operated within the regulated product category in Hong Kong. For example, a traditional fund or trust can be established, with RWA tokens serving as the fund assets or beneficiary rights. After obtaining SFC authorization, the fund shares can be publicly sold (similar to the form of public funds). Another option is to apply for the issuance of tokenized bonds and list them for trading on the Hong Kong Stock Exchange or recognized markets. The issuer must submit the prospectus for approval to the Companies Registry and the Securities and Futures Commission. This path requires the issuer to meet the standards of traditional public offerings in terms of law, finance, and risk control, including appointing a licensed institution as the sponsor/trustee, providing historical performance and due diligence reports of the underlying assets, etc. As an example, the Hong Kong Monetary Authority (HKMA) assisted in preparing a detailed issuance circular and completed the bond settlement through the Central Clearing and Settlement System (CMU). The retail path can significantly expand the investment group and enhance brand awareness, but it has a long preparation period and high costs. Moreover, due to the current limited public understanding of tokenized products, there is uncertainty in market reactions (regulation will also be more cautious). Overall, retail issuance is suitable for large-scale and reputable issuers (such as governments, financial institutions), or for considering a public offering of certain RWA after the regulations are further clarified in the future.

Requirements for securities token-related licenses: Regardless of whether the issuance is conducted through private placement or public offering, the issuance of RWA involves regulated activities and must comply with the licensing requirements of Hong Kong. The main licenses include:

- Type 1 License (Dealing in Securities): If the issuance or sale of tokens involves trading or soliciting securities in Hong Kong, the relevant institution or individual must hold a Type 1 license (or operate under the supervision of a licensed institution). For example, underwriters, distribution agents, and secondary market makers of tokenized securities all need to obtain a Type 1 license. In private placement issuance, the issuer usually hires a licensed brokerage firm as a placement agent to contact investors and arrange transactions to meet this requirement.

- Type 4 License (Advising on Securities): If the project involves providing investment advice or financial advice to investors (such as a financial advisor recommending an RWA token project to a client), then the party providing the advice must hold a Type 4 license. In practice, this means that private bank advisors, family offices, etc., who recommend clients to invest in tokenized products should also pay attention to the relevant licensing requirements.

- Type 7 License (Providing Automated Trading Services): If the project builds a trading platform to match the trading of tokenized securities (for example, allowing investors to freely list and trade token shares on the platform), then the platform falls under the category of Automated Trading Services (ATS). According to regulations, ATS operators must hold a Type 7 license and be subject to the supervision of the SFC. Currently, most RWA projects’ secondary transactions are mainly conducted through off-exchange agreement transfers, and there are no public token securities exchanges. However, some licensed brokerage firms develop internal systems for professional investors to trade tokenized assets, which actually belong to ATS and require a Type 7 license.

- Type 9 License (Asset Management): If the issuance structure involves managing a tokenized asset portfolio (for example, the issuer holds underlying assets on behalf of investors and is responsible for operation and management, similar to a fund manager), then the 9th license requirements may be triggered. In the RWA scenario, a typical example is the issuance of tokenized funds, or raising funds through tokens for specific projects and being managed by the issuer or its affiliated party. In this case, it is necessary to ensure that the manager holds a 9th license or entrust a licensed asset management company to execute to comply with the regulations.

Other supporting qualifications may also need to be considered. For example, institutions providing asset custody services may need to have a trust company license or a TCSP trust/company service provider license; structures involving providing loans may require a lender’s license, etc. The regulatory authorities remind that due to the evolving nature of token attributes and business models, it is necessary to plan the licensing layout in advance to ensure that all related activities are supported by appropriate licenses. In summary, RWA issuance is a cross-border financial innovation, but under the regulatory concept of “the same business, the same risk, the same rules” in Hong Kong, all participants still need to perform their respective duties and hold appropriate licenses to legally conduct business.

After determining the issuance route, the “domestic assets – overseas issuance” structure and loop need to be connected first.

4. Structuring for “Outbound Assets to Hong Kong”

The Special Purpose Vehicle (SPV) and Trust serve as the “bridge”, while the cross-border rights transfer and collection closed loop is the “beam”. First, the bridge must be properly constructed before the funds can cross over.

Cross-border carrier arrangements for SPV/Trust and others: If mainland assets are to be “exported” to Hong Kong for tokenization, they usually need to achieve cross-border transfer of asset rights and risk isolation by establishing a special purpose vehicle (SPV). Common practice is: The holder of the mainland assets first sets up a SPV company or trust in Hong Kong (or other offshore jurisdictions such as Cayman or BVI), transfers the assets or their income rights to this SPV, and then the SPV issues tokens in Hong Kong. Through this structure, the underlying assets are transferred from domestic entities to the name of the overseas vehicle, achieving legal and geographical isolation. Key steps include: obtaining regulatory approvals for outbound asset transfer (such as foreign exchange outbound, overseas investment filing, etc.), signing asset sale or equity transfer agreements, and legally transferring the assets to the SPV. For example, a company may package its domestic non-performing debts for issuance of tokenized products in Hong Kong, and may establish a wholly-owned subsidiary in Hong Kong as the SPV, and sign a transfer agreement with the original creditor in the mainland, selling the creditor’s income rights to the SPV, and then the SPV issues tokens representing the beneficiary shares of the debt.

During this process, cross-border compliance is the core of the structural design: The exit of asset rights must comply with the “Enterprise Overseas Investment Management Measures” of the mainland and foreign exchange management regulations, and large amounts of assets cannot be transferred privately abroad. Therefore, it is necessary to go through legal channels, such as overseas investment filing by the commerce department or the development and reform commission, and the approval of funds exit by the foreign exchange bureau. If it is a receivable under trade terms, consider transferring through a trade contract; if it is equity, consider equity sale or acquisition by an overseas SPV. Each type of asset has corresponding cross-border compliance requirements, and when designing the structure, each must be evaluated to ensure that it serves the business goals without touching the red lines of foreign exchange and foreign investment supervision.

Cross-border rights transfer and collection closed loop: After successfully transferring assets to the overseas SPV, the issuer also needs to design a closed loop for the flow of funds and income between the domestic and overseas. The funds purchased by investors usually enter the SPV account to pay for the purchase price of the assets or invest in the project. Subsequently, the cash flow generated by the underlying assets (such as interest, rent, dividends, etc.) needs to be remitted from the mainland to the SPV, and then distributed by the SPV to the token holders through smart contracts or offline channels. During this process, it is necessary to ensure that each step of the fund flow is compliant and controllable. For example, if the underlying assets are domestic loans, the borrower needs to remit the funds to the SPV as stipulated, and then the SPV distributes dividends to global investors according to the proportion of token holdings. To prevent exchange rate risks, the project often adopts a dual-currency structure (such as the underlying assets being denominated in RMB and the tokens being denominated in US dollars or Hong Kong dollars), and through banks or licensed institutions to handle foreign exchange settlement, or directly use offshore funds raised in Hong Kong to issue loans to form a natural hedge. Regardless of which method is used, it is necessary to first open the channel for fund return, including obtaining the necessary foreign debt quotas, cross-border settlement channels, and setting up fund receipt and payment nodes at the smart contract level to ensure the correspondence between the on-chain and off-chain fund flows. A well-structured closed loop should follow this sequence: investor funds → offshore SPV → onshore project → project returns → remittance back to SPV → distribution to investors, with each step supported by legal documentation and records to avoid the risk of funds being stranded onshore.

Key points for due diligence and information disclosure for different asset types: Depending on the nature of the underlying assets, the SPV needs to conduct targeted due diligence and prepare corresponding disclosure materials:

- Debt-based assets (accounts receivable, loans, etc.): Focus on investigating the credit status of the debtor, sources of repayment, the legality of the contract, and whether there are collateral guarantees, etc. The disclosure documents should include the borrower’s fundamentals, the amount of the debt, the term and interest rate, and the mechanism for handling default and disposal. If there is an assessment report or credit rating, it should also be provided. It is necessary to explain the legal validity of transferring the debt to the SPV, whether the debtor has been notified and their consent has been obtained, etc.

- Real estate/property: Verify the property title certificate, land use period, historical rental income, professional valuation report, etc. For domestic properties, if the property title cannot be directly transferred, usually the transfer of the project company’s equity or income rights is adopted as an alternative. At this time, it is necessary to explain the specific rights and interests enjoyed by the token holders under this arrangement. The information disclosure includes the property location, area, tenant situation, valuation value, rental income, and factors affecting the property value (taxes, property management conditions, mortgage rights, etc.). It should also reveal the possible legal conflicts in cross-border transfer of domestic property rights (such as jurisdictional issues of property registration, compulsory execution, etc.).

- Equity/Equity Income: If the underlying assets are the equity of mainland non-listed enterprises or stocks of listed companies, the operating conditions of the enterprises, financial statements, shareholder structure, etc., should be disclosed. If the tokenization of the equity of listed companies (such as the case where Fosun tokenized the Sisram Medical stocks) is involved, the proportion of the shares held, the market value scale, whether it triggers the obligation of information disclosure, and the lock-up period arrangement, etc., should be explained. Due to the large price fluctuations of equity assets, it is also necessary to fully alert the investors to the risks of stock price fluctuations and the measures that the issuer may take for market value management.

- Fund Shares/Financial Products: Disclose the key information in the fund’s prospectus, including investment strategies, underlying asset portfolio, historical performance, management qualifications, fee structure, etc. If the fund operates in a private equity form, the upper limit of qualified investors, the lock-up period, etc., restrictions should be explained. Usually, token holders hold the beneficial rights of the fund shares through the SPV, and it is necessary to explain the differences in rights and obligations between indirect holding and direct holding of fund shares.

- Green Assets (Carbon Credits/Light Green Certificates): Due diligence should focus on the authenticity of the assets and the verification mechanism. For example, carbon quotas should come from authoritative institutions, and green electricity certificates should be traceable to actual electricity generation. The disclosure should include the verification standards (such as CDM, CCER, etc.), validity period, usage status, and the market pricing method of these assets. Currently, global carbon prices vary greatly, and it is also necessary to alert investors to the risks of exchange rate and market fluctuations. Additionally, different jurisdictions define the attributes of carbon assets differently (some consider them as commodities, some as securities or contracts), and potential legal uncertainties should be noted.

- Computing Power/Lending Assets: Disclose the specifications of the underlying computing power equipment, operational status, existing customer contracts (if there is a long-term lease, the income is more stable), and the indicators corresponding to each token (such as how much computing power or lease rights). Explain how the expected income is calculated. If the underlying assets are data center projects, it should also disclose the policy environment of the project location (power supply, regulation, etc.). Technically, it is recommended to provide a third-party technical audit report to verify the existence and utilization of computing power resources to enhance investor confidence.

In summary, different assets require “tailor-made” due diligence lists before tokenization to ensure clear ownership and reliable quality of the underlying assets. At the same time, detailed information disclosure documents (white papers or private placement proposals) should be compiled to transparently inform investors of the asset details, transaction structure, and risk factors. Regulatory attention is particularly focused on whether the risk disclosure in the issuance materials is sufficient and true: for example, explaining the reliability of the valuation method for assets under the tokenization arrangement (valuation of non-listed assets is uncertain), the resolution mechanism for cross-border legal conflicts (which law to apply and the jurisdiction of arbitration in case of disputes), and the differences in rights between token holders and traditional holders. Only when the due diligence and disclosure processes are carried out properly can the legal and credit risks be minimized to the greatest extent, and the recognition from regulatory authorities and investors be achieved.

Once the bridge is built, it is necessary to bring in the “right type of workers” – based on the licenses and role division.

5. License & Role Mapping

Clarifying the responsibilities and licensing requirements of each participant is the guarantee for the “steady operation” of the project.

The smooth operation of the RWA project involves multiple professional roles, each responsible for specific functions and required to hold corresponding qualifications. The main roles and their compliance requirements are as follows:

- Issuance Vehicle (Issuer/SPV): The SPV company or trust established by the issuer, serving as the legal entity for the issuance of tokens. Responsibilities include holding underlying assets, issuing tokens, and maintaining asset operations. The SPV must complete legal registration and have an independent legal entity to achieve risk isolation. At the same time, it is necessary to establish KYC/AML systems and fulfill obligations such as investor identity verification and anti-money laundering review. If the SPV itself engages in regulated activities (such as securities issuance/management), it needs to apply for the corresponding license. In many cases, the SPV itself does not hold a license directly but hires licensed institutions to perform related functions to meet “piercing the veil” requirements. For example, the SPV may entrust a licensed brokerage firm to distribute tokens, hire a licensed asset manager to manage assets, etc.

- Issuance Advisor/Arranger: An intermediary that assists in designing the transaction structure, preparing issuance documents, and coordinating regulatory communication. Usually, it is an investment bank or law firm familiar with cross-border structures and Hong Kong regulations. The legal advisor is responsible for architecture design, drafting legal documents, and providing legal compliance opinions; the financial advisor is responsible for valuation, investor roadshow arrangements, etc. If the issuance involves the public market, a licensed underwriter must also participate in the review. The issuance advisor needs to ensure that the project plan complies with regulatory requirements and is feasible, and acts as the “overall coordinator” throughout the process.

- Distribution and Sales (Distributor): The channel responsible for selling the token product to investors. If the token is of a securities nature, the distribution behavior is a securities trading activity, and must be executed by a licensed brokerage firm or the securities department of a licensed bank (usually holding the 1st license), fulfilling the tasks of introducing and arranging subscriptions to customers. The distribution institution needs to conduct due diligence on the product, fully understand the product structure and risks, and provide suitability opinions to customers. If the token is targeted at professional investors, the distributor also needs to verify the customer’s eligibility. Typically, a large brokerage firm acts as the issuance coordinator, forming a distribution team to distribute tokens to multiple institutional investors.

- Asset Custody (Custodian): Divided into two parts: underlying asset custody and digital token custody. Underlying asset custody refers to the safekeeping of physical assets (funds, equity certificates, real estate title documents, etc.), usually handled by an independent third-party trust company or bank, ensuring the security of underlying assets and independence from the issuer’s control, to protect investors’ rights and interests. Digital token custody involves the safekeeping of investors’ held tokens, which can be provided by professional digital asset custody institutions or trading platforms. According to the HKMA guidelines, institutions engaged in tokenization product custody must meet the security standards for digital asset custody, including private key security management, anti-hacking and theft prevention, consistency of chain-based/on-chain records, and emergency redemption mechanisms, etc. Many projects adopt multi-signature or custody wallet solutions to reduce single-point failure and private key loss risks. If a third-party custody is introduced, its license requirements (some jurisdictions require licenses for custody business) and risk transfer through insurance should also be considered. The custodian in the RWA framework plays the role of “asset gatekeeper”, and the independence and stability of the custodian are crucial for building investor trust.

- Valuation and Audit: To ensure the authenticity and transparency of the value of the tokens corresponding to the assets, an independent valuation and audit mechanism needs to be introduced. Valuation institutions (accounting firms or professional assessment companies) should conduct valuations of underlying assets on a regular basis or when necessary. For example, the real estate industry provides professional valuation reports annually, and loan portfolios are regularly assessed for impairment. The valuation methods must be disclosed in the issuance documents and remain consistent. The auditor is responsible for auditing the financial statements of the SPV and the changes in the rights and interests of the token holders, usually once a year, and issuing an audit report. This is particularly necessary in public offering products; even in private projects, if the duration is long, it is recommended to provide audited financial statements to investors annually. The scope of the audit includes verifying whether the underlying assets exist, whether the cash flow is distributed as agreed, and whether the SPV has undisclosed liabilities, etc. The audit work must be carried out by a licensed accounting firm. Currently, major institutions such as the Big Four accountants have begun to engage in digital asset auditing, providing professional endorsements for the market.

- Platform and secondary market operators: If the RWA token is planned to provide trading liquidity after issuance, the corresponding platform operator must also “hold a license”. If the platform trades non-securities tokens (such as pure carbon credit tokens), then a virtual asset trading platform license (VASP) must be obtained; if trading securities tokens, the platform should obtain the SFC-recognized ATS qualification, or match transactions through the internal system of a licensed broker. The platform operator must establish complete trading rules, monitoring, and compliance systems. For example, only whitelist addresses that have completed KYC can participate in trading, set a single transaction limit, monitor abnormal trading and market manipulation behaviors, etc. At the same time, there should be a market-making arrangement to provide basic buying and selling depth. Usually, the issuer will enter into a strategic partnership with a licensed trading platform, and after token issuance, the platform will provide secondary trading services to investors. The platform operator, in addition to its technical responsibilities (maintaining matching and wallet systems), also needs to ensure that transactions comply with anti-money laundering and anti-terrorist financing requirements and fulfill the obligation to report suspicious transactions. This is similar to the compliance requirements of traditional stock exchanges/brokers. Only the technical carrier has changed to blockchain.

In conclusion, the RWA project is not an individual effort by the issuer, but rather a puzzle of professional division of labor: the issuer provides reliable assets and the overall plan, the licensed intermediaries ensure the compliance of distribution and transactions, the custodian ensures the security of assets, and professional institutions provide valuation and auditing endorsements. Each role must clearly define its own responsibilities and regulatory requirements, and ensure that “whoever’s responsibility is borne by whom, and whoever has the license holds it.” Together, they build a trustworthy tokenization ecosystem. Only in this way can investors enjoy the same level of protection and services as in traditional finance when they come into contact with emerging RWA products.

People and licenses in place, start “writing rules into the system” – enter technology and operations

6. Technical and Operational Requirements

“Regulatory rules” should be translated as “contract parameters”, as they are the key to the successful implementation of tokenization.

- Whitelist Mechanism and Transferability Restrictions: RWA tokens usually do not flow freely on the blockchain like public cryptocurrencies. Instead, whitelisting or transfer restrictions are set to comply with securities laws and investor suitability requirements. Specifically, the issuer embeds control logic in the smart contract: only wallet addresses that have passed KYC verification and are included in the whitelist can hold and transfer the tokens. If the tokens are restricted to professional investors only, only the addresses of qualified investors will be added to the whitelist. Once the holder attempts to transfer the tokens to an address not on the whitelist, the contract will reject the transaction. This ensures that the tokens do not circulate in an uncontrolled environment, avoiding the public dissemination of violations. Additionally, the contract can set lock-up periods and transfer limitations, such as prohibiting transfers within 6 months after issuance, or requiring approval from the issuer for each transfer. In terms of technical implementation, many platforms adopt controlled token standards like ERC-1404 or develop their own modules to manage the transfer permissions on-chain. The whitelist mechanism needs to be coordinated with the offline registration mechanism to ensure clear and traceable identities of the blockchain holders. This is crucial for regulation, as it enables the identification of the actual holders and transaction paths in case of any violations or disputes.

- Custody and Wallet Arrangements: The secure custody of digital tokens is a top priority in operational management. On one hand, issuers need to select appropriate wallet solutions to store project tokens and private keys, such as token issuance minting wallets, multi-signature custody wallets, etc. The common practice is to use multi-signature wallets, where multiple parties (such as issuers, custodial banks, lawyers) jointly manage the private key fragments. Any token transfer requires a preset number of signatures for authorization to prevent single-point leakage. On the other hand, for the investor side, two modes can be adopted: custodial accounts or self-managed wallets. Custodial accounts are managed by the platform or trust institution on behalf of the investors, and the investors see the account balance; self-custody is where the investors use their own blockchain wallets to receive tokens. Both modes have their advantages and disadvantages – custodial accounts are convenient for management and retrieval of lost assets, but the investors do not control the private keys; self-custody gives the investors full control over the assets, but it requires higher security management requirements for private keys. Hong Kong regulators are highly concerned about virtual asset custody, and the HKMA requires custodial institutions to adopt rigorous measures such as separating hot and cold wallets, backing up private keys, and multi-factor authentication. The operator needs to formulate wallet management procedures, such as which tokens are stored in cold wallets (offline and stored for high security) and which are stored in hot wallets (online to meet liquidity needs); clearly define the authorization and handover mechanisms for private keys to prevent any single person from transferring assets. To enhance security, many projects purchase insurance for custody assets or use multi-signature + time lock to achieve recoverable permissions in case of private key loss. In summary, a well-implemented wallet and custody arrangement is the key bottom line for ensuring the security of RWA project assets.

- Secondary Liquidity Design: Unlike listed securities, most RWA tokens have limited liquidity in the secondary market during the initial issuance stage, requiring careful design of trading channels. Firstly, the project team usually introduces market makers or quote support. After the issuance is completed, one or more market makers are designated to provide bilateral quotes in the over-the-counter market, providing the foundation for liquidity for the tokens. These market makers are mostly securities firms or institutional investors involved in the project, who profit from the spread and bear the inventory risk. Secondly, if the token is listed on a licensed trading platform, the platform can discover the price through competitive matching or regular auction mechanisms. Some projects conduct regular competitive trading every week to avoid continuous fluctuations. There are also projects that design a buyback/redemption mechanism: for example, allowing holders to sell back the tokens at a certain discount to the issuer at the end of each quarter, providing support for the token price. A recent innovative practice in Hong Kong is the tokenization of stocks: in September 2025, Fosun Group tokenized the equity of its Sisram Medical listed stocks, allowing investors to trade the equity on the blockchain 7×24 hours. This breaks through the trading time restrictions of traditional stock markets, allowing global investors to participate around the clock, and is regarded as a highlight in improving liquidity. However, currently, such on-chain transactions are only available in controlled environments (open only to qualified investors). Overall, the secondary liquidity of RWA tokens requires a balance between providing necessary exit routes and preventing excessive speculation. A common practice is to limit market participation to professional investors familiar with the asset value in the early stage, allowing the price to mainly reflect the performance of the underlying asset; after the project matures and information transparency improves, the participation scope can be gradually expanded, and ultimately achieve broader liquidity.

- Data Compliance and On-Chain Monitoring: The operation of RWA tokens must meet the requirements of data management and on-chain monitoring. On one hand, the platform must abide by the Hong Kong Personal Data Privacy Ordinance, securely store investors’ KYC information, and not disclose identities at will. However, it must also meet the regulatory “piercing” review requirements and, when necessary, be able to correlate on-chain addresses with real identities and provide them to the regulatory authorities. Many platforms adopt a combination of on-chain identification and off-chain real-name databases: on-chain records the address and token quantity, while the real-name information of investors is stored in a secure database and managed by the compliance department. On the other hand, the platform needs to implement similar transaction monitoring mechanisms as in traditional finance, such as setting up abnormal transaction alerts (large-scale transactions within a short period, abnormal price fluctuations, etc.) and anti-money laundering pattern recognition (rapid transfer of chain funds to suspicious addresses). Once suspected illegal activities are detected (such as someone attempting to transfer large amounts of funds using the token), an investigation should be promptly initiated and reported to the relevant authorities. Fortunately, the transparent and traceable nature of blockchain provides new tools for regulation that the operator can use on-chain analysis software to track the movements of large addresses in real time, monitor token concentration, and flow. This helps to detect early signs of market manipulation, insider trading, etc. For example, if the token price surges in a short period, the operator can analyze the on-chain data to determine whether a few addresses are buying and selling to drive up the price, and based on this, issue risk warnings to investors or restrict trading. Data compliance also involves cross-border data transmission: if there are mainland investors or asset data on the chain, it is necessary to comply with the data export regulations of the mainland, and may need to anonymize sensitive data before uploading it to the chain, or keep core data in the domestic off-chain system. Finally, the disclosure of important on-chain events cannot be ignored. Once there are technical events such as smart contract vulnerabilities, hacker attacks, token contract upgrades, etc., the operator should promptly inform holders through the official website, platform announcements, or even blockchain announcement functions, maintaining information transparency. The technical operation team needs to cooperate with the compliance department to combine traditional risk control measures with the characteristics of blockchain, create a continuous monitoring and timely response on-chain monitoring system, and ensure that the RWA ecosystem operates in a controllable environment.

After the rules are launched, risks and protection should be pre-fixed and solidified to avoid “launching and then encountering problems”.

7. Risk Disclosure and Investor Protection

For the five types of risks: technology, law, valuation, liquidity, and cross-border execution, there are respective “handles” for addressing them.

- Technical Risk: The introduction of RWA tokens has brought a series of technical risks related to blockchain. These risks need to be fully disclosed and prevented. The most prominent one is the risk of smart contract vulnerabilities – the issuance management relies on smart contracts, and hackers may exploit these vulnerabilities to steal assets or tamper with accounts. Therefore, regulatory requirements state that before issuance, an independent smart contract security audit must be conducted and the results provided to investors for reference. The second is the risk of blockchain network failures: if the underlying chain goes down or forks, it will affect token trading and settlement. Especially when using a public chain, the irreversible transaction risk should be noted – if there is a mistransfer or theft, the assets may not be recoverable. There is also the risk of private key management: if the investor or the custodian loses the private key, the corresponding token will be permanently unavailable. The disclosure of technical risks should be explained in plain language about the possible scenarios and consequences. To protect investors, the issuer and the platform need to take multiple preventive measures, such as the aforementioned contract audit, multi-signature custody, cold-hot separation, etc., and establish emergency plans (such as suspending the contract in case of hacker attack, activating backup settlement plans, etc.).

- Legal and Compliance Risk: Cross-border tokenization arrangements involve complex legal relationships, and investors may face the risk that rights cannot be effectively enforced. For example, can the tokens held by investors be legally recognized in the jurisdiction where the underlying assets are located? If the underlying assets have a default or dispute in the domestic jurisdiction, can the token holders, as foreign equity holders, smoothly claim rights through legal channels? These need to be explained in the risk disclosure. There are also issues of conflicts between different judicial jurisdictions: token transactions occur on the chain, and the participants are globally distributed, but the underlying assets and the issuer are subject to specific judicial jurisdictions. In case of an incident, which jurisdiction’s law should be applied and where should it be filed needs to be pre-described. The regulatory attention also focuses on the conflicts between traditional laws and smart contract rules: for example, the automatic execution of smart contracts may conflict with court injunctions – if an investor goes bankrupt and the court requires the freezing of their assets, but the chain cannot unilaterally freeze the address, this contradiction needs to have a solution in advance. In terms of compliance risk, it is necessary to indicate the potential impact of regulatory policy changes. For example, if the law redefines a certain type of token as securities, the holding and trading of investors will be subject to new regulations, and they may need to go through additional procedures or even affect the legality of the token. Especially for cross-border issuance, it is necessary to pay attention to the regulatory dynamics in the mainland and Hong Kong: if the mainland strengthens the control over residents’ participation in overseas token investment, investors may face compliance obstacles. The issuance documents should disclose the existing legal opinions under the current structure, as well as which matters have uncertainties (regulatory gray areas) that need investors to assess independently.

- Valuation and Liquidity Risk: RWA tokens often lack an active public market, exposing investors to the risks of uncertain valuation and insufficient liquidity. If the underlying assets are non-listed assets, their fair value is difficult to price in real time, and the token price usually relies on regular assessment or model valuation. There is an error margin in the asset net value. Especially during market fluctuations, model valuation may lag or be inaccurate, leading to a significant deviation between the secondary market price of the token and the fundamental value. Investors should be informed that the value fluctuation of the tokens they hold may be more volatile than the underlying assets, as liquidity discounts and market sentiment can affect the trading price of the tokens. Additionally, the limited exit channels are also a major risk point – tokens may not be able to be sold and realized immediately, especially when there is no secondary market market-making support. Investors may only be able to hold until the project ends to obtain returns or wait for the issuer to repurchase. In extreme cases, even if the book value of the tokens is high, there may be no takers, and they cannot be realized. Project parties need to clearly specify the liquidity arrangements (whether they plan to list on exchanges, whether they provide a repurchase mechanism, etc.) in the documents, and inform investors of the possible liquidity shortage during the holding period. The SFC of Hong Kong emphasized in 2019 that unapproved tokenized securities, in principle, should not be offered to retail investors, partly due to concerns that retail investors may get into products with poor liquidity and be unable to exit. Therefore, currently, restricting participants to professional investors is also a form of protection against liquidity risks.

- Cross-border Execution and Exchange Rate Risk: For cross-border RWA projects, investors need to understand the risks related to cross-border legal execution and exchange rate conversion. If the underlying assets are in the mainland, token holders as foreign creditors may face issues of mutual recognition between the two regions when executing judgments – mainland courts may not recognize the rights of token holders on the assets on the blockchain, and may require a cumbersome legal process. Investors must accept the uncertainty of realizing their rights. On the other hand, the capital control of the RMB means that there is a risk of exchange rate conversion for future returns: if the policy tightens, the returns of the underlying assets cannot be remitted to Hong Kong on time, which will directly affect the investment returns of the tokens. Moreover, currency mismatch also brings risks: for example, the returns of the underlying assets are denominated in RMB but the tokens are denominated in US dollars, and currency fluctuations during this period may cause the investment returns to deviate from expectations. Even if the project parties take hedging measures, they should remind investors that exchange rate fluctuations may harm their returns. Overall, in the current situation where there are still institutional differences between the mainland and Hong Kong, RWA projects cannot completely eliminate the inherent risks in cross-border aspects. Investors need to consider whether they can tolerate these uncertainties based on their own circumstances.

- Investor Protection Mechanism and Regulatory Expectations: To maximize the protection of investors’ interests, RWA projects and regulatory authorities have set up a series of protection measures. Firstly, there is suitability management, ensuring that the appropriate products are sold to the appropriate people – as mentioned earlier, most projects limit participation to professional investors to ensure that participants have the corresponding knowledge and risk tolerance. For a few pilot projects that allow retail participation, it is also conducted within the regulatory sandbox and is accompanied by mandatory investor education and limit control. Secondly, project documents usually contain investor protection clauses, such as how to liquidate and distribute when the underlying assets are prematurely disposed of; if the asset manager defaults, how to replace the manager under the trust structure; whether major matters (asset sale, refinancing, etc.) require the consent of token holders for voting, etc. These clauses give investors certain decision-making and supervisory rights. The regulatory authorities also expect issuers to establish smooth channels of investor communication, such as designating investor contacts, providing holder reports regularly or holding holder meetings, allowing investors to understand project progress and raise questions. In addition, Hong Kong has a mature investor complaint and dispute mediation mechanism, and RWA token holders can seek legal remedies or file complaints with the regulatory authorities when encountering problems. It should be noted that the investor compensation system (such as the investor compensation fund of the CSRC) currently does not cover unapproved token products. Therefore, investors cannot expect the government to provide a guarantee. This point should also be clearly informed. Overall, the regulatory attitude towards RWA is to encourage innovation while requiring “bottom-line stability.” Through the above protection measures, participants should be fully aware of the risks, bear the risks themselves, and at the same time prevent fraud and ensure proper information disclosure to maintain the long-term healthy development of the market.

The risks should be clearly stated and continuously disclosed so that investors can “see and calculate”.

8. Information Disclosure and Reporting

Before issuance, “clarify clearly”; during the holding period, “maintain continuity”; for technical incidents, “report promptly”.

- Offering Documents and Technical Risk Disclosure: For issuing RWA tokens, detailed offering documents (private placement prospectus or prospectus) need to be prepared. The quality of information disclosure directly affects investors’ decisions and compliance. The documents should include: project overview (token corresponding assets and issuance purpose), introductions of all parties involved (issuer/SPV structure, custodian, auditor, trading platform, etc.), details of underlying assets, transaction structure diagram, investment terms (token equity design, term, income distribution, exit arrangement, etc.), and risk factor explanations. Especially in the risk disclosure section, additional explanations should be provided for the characteristics of tokenization, such as the legal effect of on-chain/off-chain settlement, token transfer restrictions, audit conclusions of smart contracts, cybersecurity measures, and emergency handling mechanisms, etc. Hong Kong regulatory requirements state that disclosure must be comprehensive, accurate, and understandable, avoiding excessive technical terms that prevent investors from understanding. For innovative risk points (such as irreversible transaction risks due to the use of public chains, possible changes in regulatory policies), special warnings should be given. In addition, in terms of technical operations, some offering documents may attach IT statements or technical white papers, detailing blockchain architecture, smart contract logic, security test results, etc., for reference by investors with technical backgrounds. This is equivalent to combining the offering memorandum of traditional securities issuance with the white paper of blockchain projects, meeting regulatory requirements while providing necessary technical transparency.

- Regular/Unscheduled Information Disclosure: During the holding period of the RWA project, it should follow the information disclosure requirements of traditional securities/funds to provide investors with regular reports and necessary interim reports. Regular disclosure usually includes annual and semi-annual reports, covering SPV financial statements, underlying asset operation status, current income distribution, and updates on significant matters affecting asset value. If the underlying assets are operating enterprises or projects, it is advisable to attach the management discussion and analysis (MD&A). These reports, if audited or reviewed, can enhance credibility. For closed private placement projects, there are no mandatory regular disclosures by regulators, but high-quality projects often voluntarily refer to the requirements of public offering funds and provide quarterly or semi-annual reports to maintain investor confidence. Unscheduled disclosure is required when major events occur, such as significant defaults of underlying assets, lawsuits, asset impairment, or changes in the custodian institution, regulatory environment, etc., and should be promptly disclosed through formal notifications or announcements. Particularly, the disclosure of chain-related events is worthy of attention: if smart contracts have been upgraded, vulnerabilities have been patched, or there have been hacker attacks, these technical events should also be regarded as major matters and notified to the holders. Since these technical events may not be included in the traditional disclosure list, the issuer needs to establish a system to identify which chain-related situations are major matters and disclose them. Information disclosure channels can be diverse – private placement projects are usually directly notified to investors through email/telephone conferences, while public projects can issue announcements on the exchange announcement platform, official website column, or even through the announcement function on the blockchain browser (ensuring synchronization of chain-on-chain information). In terms of regulation, for retail products, the SFC will supervise whether continuous information disclosure is in place; for private placement products, although there are no hard regulations, good information disclosure helps reduce disputes and win a market reputation.

- Special Requirements Related to Stablecoins: If the RWA project involves the use or issuance of stablecoins, it is necessary to pay attention to the special regulatory requirements for stablecoins in Hong Kong. Firstly, according to the “Stablecoin Regulations”, issuing stablecoins that anchor the value of a legal tender in Hong Kong is a regulated activity. If the project team plans to issue a token that anchors the value of a certain legal tender (such as a stablecoin denominated in RMB for settlement purposes), they must obtain a license or exemption; otherwise, they cannot provide it to the public. Therefore, currently, RWA projects generally do not directly issue new stablecoins but use existing compliant stablecoins as the transaction medium. If, during operation, stablecoins such as USDT/USDC are used to raise funds or distribute dividends, attention must be paid to the related settlement risks, including the risk of stablecoin price fluctuations or depegging, the credit risk of the issuer, etc. In a joint statement in 2025, the regulatory authorities reminded the market to pay attention to the potential market fluctuations and credit risks of stablecoins. Project teams should disclose to investors the types of stablecoins used, the background of the issuer, the 1:1 reserve guarantee, and the measures to be taken in extreme cases (such as the collapse or freezing of stablecoins). Additionally, according to the new regulations on stablecoins, during the transition period, unlicensed stablecoin issuers can only provide their tokens to professional investors. Therefore, if the RWA project plans to introduce an unlicensed stablecoin as a payment method, it is necessary to limit the investors to a professional group to avoid violations. Finally, anti-money laundering and on-chain monitoring of stablecoins are also very important. If the project accepts stablecoin contributions, it should use wallets or exchanges that comply with the Travel Rule (travel rules), record the source and destination of the funds, and prevent money laundering activities from infiltrating. In summary, stablecoins can provide a convenient bridge for value exchange for RWA projects, but their own risks and regulatory requirements must not be ignored. They should be fully covered in project design and information disclosure.

After achieving information transparency, secondary liquidity can be steadily opened.

9. Secondary Market and Market Making

Start with “controllable liquidity”, then move on to “sustainable liquidity”.

- VATP Licensed Trading Process: If the RWA token is planned to be traded on a Hong Kong licensed virtual asset trading platform (VATP) after its issuance, the process will be strictly regulated. First, the platform will only allow qualified users (professional investors need to provide asset proof, etc.) to trade after completing real-name KYC. Before launching any token, the platform must conduct due diligence on the token in accordance with the SFC guidelines to ensure that it does not belong to prohibited or restricted assets (such as unlicensed security tokens or algorithmic stablecoins) and that the project is trustworthy. Once the token is approved for listing, the general trading process typically includes: Investors deposit fiat currency or recognized virtual assets into the platform account -> Submit buy/sell orders -> The platform matches the orders -> The token and funds are settled in the platform ledger. It should be noted that currently, licensed VATP platforms still have restrictions on allowing retail investors to participate, only opening up a few mainstream virtual asset trading, and most RWA tokens, even if listed on the platform, are only available in the professional investor zone to comply with regulations. During the trading process, the platform needs to continuously monitor the market to prevent manipulation and insider trading. If any anomalies are detected (such as sudden large buy orders pushing up the price), the platform has the right to suspend token trading and conduct an investigation. Additionally, the platform has the obligation to disclose information. For example, when the issuer releases important announcements, it should promptly notify users. Overall, trading RWA tokens on VATP is similar to trading stocks on a formal stock exchange, with different asset categories but consistent compliance requirements. Investors need to be fully informed of product information and risks before trading and are subject to exchange rules, monitored, and protected during the transaction.

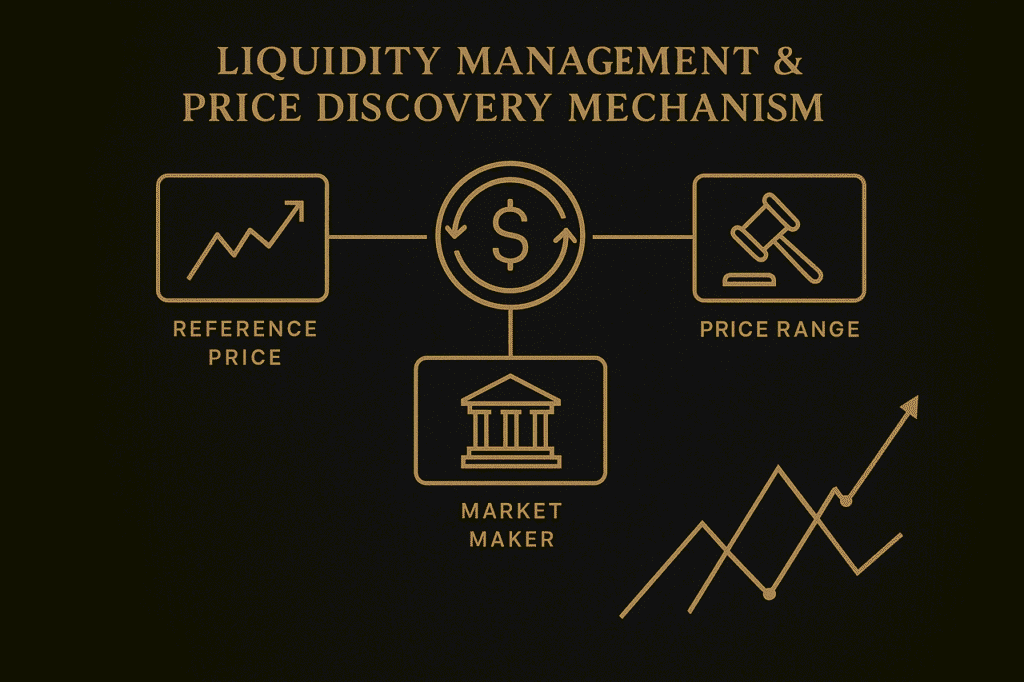

- Liquidity Management and Price Discovery Mechanism: Since the underlying assets of RWA tokens are often unique and have low market recognition, liquidity management is a challenge for both the issuer and the platform. To facilitate price discovery, some projects introduce anchoring mechanisms or reference index prices when issuing. For example, if the token is anchored to a listed stock, the stock market price can be used as the reference benchmark; if anchored to a bond, it is valued based on the coupon and market interest rate model. With a benchmark price, market makers can quote buy/sell prices within a certain range around the benchmark price to guide the token price to fluctuate based on the fundamentals. Market makers themselves can be affiliated parties of the issuer or professional institutions, providing liquidity through continuous quotations. Some projects also set up “price cages”: limiting the token trading price within a certain reference range (a certain percentage above or below the benchmark price), and transactions are invalid if exceeded, to prevent extreme and absurd prices. On the other hand, with the development of DeFi, some projects attempt to introduce RWA tokens into decentralized exchanges (DEX) liquidity pools, using the AMM algorithm to provide continuous liquidity. However, due to regulatory considerations, Hong Kong-issued RWA tokens are currently rarely directly listed on open DEX; regulation prefers controlled liquidity provision methods, such as being traded by recognized market makers on licensed platforms, so that transaction records can be audited and abnormal behaviors can be held accountable. In terms of price discovery, if the underlying asset has an open market price (such as listed stocks, marketable bonds), the token price should theoretically be closely linked to it; otherwise, there will be arbitrage opportunities. For example, for the Sisram Medical stock tokenized by Fosun, its on-chain trading price should be basically consistent with the stock price on the Hong Kong Stock Exchange, and the participation of cross-market arbitrageurs will ensure the linkage between the two. However, if the underlying asset has no readily available market price (such as unlisted real estate), the token price is mainly determined by the judgment of the participants on the value of the asset, and the initial fluctuations may be large. To increase price transparency, the issuer usually regularly publishes information such as the net asset value and income data of the underlying asset to help investors adjust quotations. The regulatory authorities hope to see the actual market price formation rather than the issuer’s control. Therefore, they have requirements for the market-making behavior: no insider manipulation, and no self-buying and self-selling to create false transactions. Ideally, as more investors participate and information becomes transparent, the price of RWA tokens can fully reflect the true value of the underlying assets and market expectations. Its trend will be linked to the traditional market value trend, thereby fulfilling the true function of value discovery.

After the route and mechanism are clarified, the scheduling and budgeting process begins, and the project is pushed onto the “progress table”.

10. Project Timeline and Cost Framework

Breaking down complex matters into milestones makes the time and cost “manageable”.

Project Timeline: Launching an RWA project for mainland assets to go public in Hong Kong usually takes several months, depending on the complexity of the assets and the regulatory procedures. A typical schedule is as follows:

- Pre-feasibility study (T-6 months): The issuer and legal advisors assess whether the asset is suitable for tokenization, design the basic framework and business plan, including choosing the blockchain platform, initial transaction structure, target investor group, etc. This stage requires obtaining internal company approval and reaching preliminary intentions with potential partners (brokers, platform providers).

- Architecture setup and regulatory communication (T-4 months): Set up an SPV or trust vehicle in Hong Kong, initiate the approval process for the mainland assets’ export (such as filing with the National Development and Reform Commission, foreign exchange registration, etc.). At the same time, communicate the plan with the regulatory authorities in Hong Kong (for private placement projects, informal consultations can be conducted; for public offering projects, preliminary discussions with the SFC on feasibility should be held). The technical team starts developing smart contracts, and the legal team drafts the initial draft of the issuance documents. This stage requires clarifying the licenses required for the project and the way to obtain them (self-application or cooperation with a licensed institution).

- Due diligence and document finalization (T-2 months): Conduct a comprehensive due diligence on the underlying assets, issue valuation reports, legal opinions, etc. Based on the results of the due diligence, complete the issuance white paper/charter documents, including all necessary information disclosure. Invite auditors to review the financial and asset ownership of the SPV. After the documents are basically finalized, if regulatory approval is required, submit them for review (for public offering projects, this is done to the SFC before the offering date; for private placement projects, they should be sent to potential investors). Smart contract development and security audits are completed at this stage. At the same time, determine the issuance terms (issuance size, price/interest rate, term, etc.), and draft investor promotion materials.

- Issuance and distribution (T=0): Officially issue the tokens according to the planned date. If it is a private placement issuance, arrange investor roadshows and one-on-one negotiations before and after the offering date. Investors sign the subscription agreements and pay the funds, and the SPV delivers the tokens to the investors’ addresses. This process can last from several days to several weeks until the fundraising amount reaches the expected target. If it is a public offering issuance, accept public subscriptions during the subscription period after the prospectus is made public. Winners receive allocated tokens. After the issuance, issue a trading announcement or allocation result announcement.

- Secondary market market-making launch (T+0.5 months): If the project plans to provide secondary market trading, it is generally launched within one or two weeks after the settlement and delivery of the offering. Market makers start to provide bilateral quotations for the tokens, or open the trading function of the platform according to the agreed time. The operation team closely monitors the initial market performance to ensure system stability and smooth trading. In case of abnormal situations, they can handle them promptly.

- Project continuation management (T+subsequent steps): The project enters the normal operation stage. The underlying assets generate income on schedule, and the SPV distributes them to token holders through chain-based or offline channels (such as quarterly interest payments, dividend distributions, etc.). At the same time, issue regular reports and temporary announcements at the established frequency (refer to the information disclosure section). When the project expires, it is liquidated or redeemed according to the terms in the documents, recovering the value of the underlying assets and distributing them to token holders, destroying the tokens or making them invalid, completing the entire cycle. A project from issuance to conclusion may take as short as six months, or as long as several years or even longer, during which continuous operation and compliance management are required.

Different project timelines will vary. Pilot projects may spend more time on regulatory communication and architecture design; conversely, simple small-scale projects may be completed within 2-3 months. Overall, sufficient time needs to be reserved to deal with regulatory approvals and various uncontrollable factors (such as delays in domestic approvals). Planning key milestones and urgent paths in advance is crucial for the success of the project.

Cost basket and budget considerations: The costs of the RWA project can be summarized into several major “baskets”, and the issuer should conduct a budget assessment to evaluate the economic feasibility of the project:

- Legal/compliance and auditing costs: This includes the fees for hiring law firms to design the structure, drafting documents, and providing legal opinions; the fees for applying for licenses or product approvals (official charges and consultant fees); as well as the fees for professional services such as auditors, assessors, etc. Professional service costs in Hong Kong are relatively high, depending on the complexity of the project. The legal costs for complex projects can reach several million Hong Kong dollars, and the auditing and assessment costs also require several hundred thousand Hong Kong dollars. If a credit rating agency is involved, additional costs or benefit arrangements should also be included.

- Custody/trust and platform service costs: This includes the service fees of the underlying asset custodian or trust company, as well as the service fees of the token issuance technology platform or trading platform. Custodians usually charge management fees annually (at a certain percentage of the asset size or with a minimum charge). Digital issuance platforms may charge listing fees or technical access fees, as well as commission splits for secondary market transactions. If the platform provides market-making support for the project, additional fees or benefit arrangements may be required. In Hong Kong, cooperation with licensed brokers/exchanges often requires a certain consideration, such as transaction commissions, consulting fees, etc.

- IT development and system monitoring costs: The issuer needs to invest in technical development costs, including the writing and auditing of smart contracts, security testing, and the development of front-end systems (such as investor registration, report query, etc.). If using a third-party blockchain issuance platform, token minting fees, contract deployment fees, etc., may be required. During the operation phase, blockchain nodes or monitoring systems need to be configured to track token transactions and ensure network operation, which also has ongoing costs. In addition, information security investment (firewalls, vulnerability scanning, etc.) is indispensable. For large projects, it may be necessary to build or purchase blockchain monitoring tools for compliance analysis, which belongs to RegTech compliance technology costs.

- Administrative and distribution costs: This includes marketing promotion expenses (such as roadshows for professional investors, information sessions, etc.), investor relations maintenance costs, and the human costs of the project management team. If distributed through brokers, there may also be underwriting/discount commissions, usually paid to the distribution channel at a certain percentage of the raised amount. If the project involves cross-border operations, personnel travel expenses, and conference fees should also be included. Finally, if involving foreign exchange hedging, interest rate swaps, etc., financial operations, corresponding costs will also be incurred.

In summary, the fixed cost investment for the RWA project is not low, and it is suitable for larger-scale financing needs. Otherwise, the cost proportion will be too high. Industry experience shows that legal and license fees are usually the largest upfront expense, followed by technical development and platform costs. For example, for a tokenized note project with a fundraising amount of several hundred million Hong Kong dollars, the start-up costs may reach several million Hong Kong dollars, accounting for about 5-10% of the fundraising amount. The larger the project scale, the lower the relative cost proportion. The issuer needs to weigh: whether the incremental funds or cost savings obtained from tokenization financing can cover the upfront investment. If a large amount of capital is invested in a concept trial but raises little, the economic viability of the project is questionable. Therefore, it is recommended to establish a financial model in advance, calculate the cost proportion under different fundraising scales, and explore methods to reduce costs (such as sharing the same issuance platform and SPV for multiple projects to spread costs, striving for government subsidies such as the HKMA Digital Bond Funding Scheme). In Hong Kong, the government and industry institutions are launching incentive measures to reduce the cost of tokenization pilot projects. For example, the Hong Kong Monetary Authority once provided a subsidy of up to 2.5 million Hong Kong dollars for the issuance of tokenized bonds. Issuers should actively utilize these resources, optimize the cost structure, and improve the project’s feasibility.

11. Practical Checklist

Legal Compliance Checklist: