Introduction

With a series of recent depegging-related security incidents, the entire crypto industry has entered its own version of a “butterfly effect.” From stablecoins losing their peg to liquidity pools triggering chain reactions, risks are rapidly spreading across protocols. A sense of unease is permeating the market, bringing previously dormant issues back into the public eye and prompting the question: In an on-chain world full of uncertainty, what is a “true stablecoin“?

Stablecoins are not only a medium of on-chain transactions—they are the “foundation” of the on-chain economic system. When market trust is challenged, only stablecoins with transparent mechanisms and solid backing can remain steady amid volatility. This is precisely the value of BUSD on the BenFen chain: it does not rely on complex hedging strategies or high-leverage yields; instead, it provides a dollar-pegged token with zero depegging risk through a rigid-redeem cross-chain lock-and-mint model.

I. What Is BUSD: The Native USD-Pegged Token on the BenFen Chain

BUSD is a USD-pegged token minted 1:1 through cross-chain USDC/USDT.

Using the BenFen native cross-chain bridge mechanism, it maintains a strict 1:1 peg to USDT/USDC and other mainstream USD stablecoins transferred from other chains, achieving rigid redemption and constant value. This makes it a highly liquid, low-risk settlement unit within the system—the core pegged asset of the BenFen chain, designed for on-chain payments and value circulation. It is a fundamental component of the PayFi network. Unlike traditional pegged coins issued at the contract layer, BUSD is not a yield-bearing stablecoin, but an on-chain mapping of the U.S. dollar, enabling seamless switching between DeFi and real-world payments. Natively supported by the BenFen public chain, BUSD is the “first-class citizen” of the ecosystem—users can even pay gas fees directly with BUSD, creating a true stablecoin-native payment experience.

II. How BUSD Works

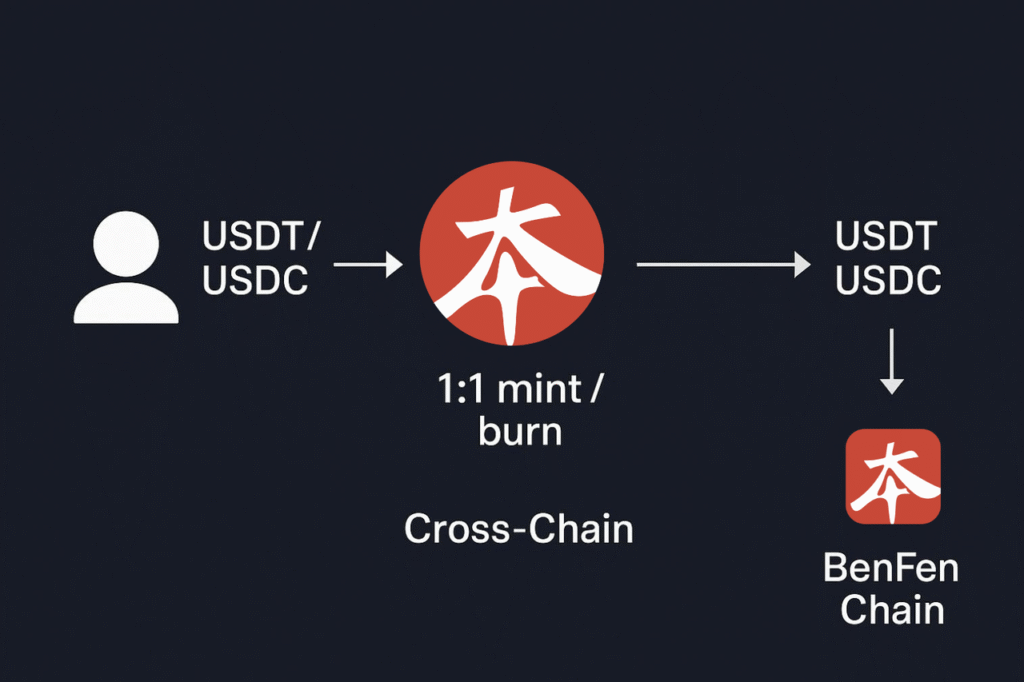

BUSD’s stability comes from cross-chain mapping and a real-time mint-and-burn model.

When users transfer mainstream stablecoins such as USDT or USDC across chains to the BenFen chain, the system will automatically generate an equivalent amount of BUSD on the chain. When a user chooses to exchange BUSD back for external assets, the corresponding amount of BUSD will be burned in real time on the chain, while the native assets will be released from the bridge and returned to the user’s address. The operation logic is:

- When users cross-chain USDT/USDC into the BenFen chain, the system will automatically mint it into BUSD at a 1:1 ratio.

- When users redeem, BUSD can be withdrawn across chains and exchanged back into USDT/USDC at a 1:1 ratio.

- All mint and burn operations are recorded in real time on the chain, and the process is transparent and traceable.

This mechanism ensures a strict USD peg, eliminates third-party custody and trust risks, and guarantees the verifiability and stability of the asset backing.

III. Security Assurance: Native Architecture & Rigid Redemption

BUSD’s security does not rely on after-the-fact interventions; it eliminates depegging risk at the root. Its strength lies in a pure 1:1 reserve model with no leverage, hedging, or off-chain trading strategies. This avoids systemic risk caused by market volatility. Unlike contract-layer re-issued stablecoins, BUSD is embedded at the blockchain’s native layer, built with the Move language, offering superior execution safety and system-level protection.

Key features:

- Native Security: Move provides formal verification capabilities for asset management and state validation, preventing over-issuance and logical flaws at the language level.

- Rigid Redemption: Every BUSD is backed by equivalent USDT/USDC reserves, ensuring verifiable 1:1 minting and redemption.

- On-Chain Traceability: All mint and burn records are public, allowing users to verify reserves at any time and eliminating any possibility of a black box.

- Multi-Layer Cross-Chain Bridge Protection:BenFen Bridge uses high-threshold multi-node consensus, settlement delays, and per-transaction limits to resist chain reorganizations and abnormal flows.

Most importantly, BUSD follows a “simplicity equals security” philosophy: No complex yield routes → no hidden contagion risks. Users always retain control of their funds. Redemption is fully symmetric: as long as they hold BUSD, it is equivalent to holding USDT/USDC certificates that can be exchanged at a 1:1 ratio at any time. Even if external chains face liquidity shortages or violent price swings, the locked reserves remain intact, and BUSD can still be redeemed at face value.

IV. Real-World Use Cases

On the BenFen chain, BUSD serves as both a value medium and a base-layer asset, widely used in:

- Gas Fee Payments: Users can pay gas fees in BUSD directly when interacting with DApps, transferring tokens, or performing on-chain operations—no need for holding additional native tokens.

- On-Chain Payments & Settlement: BUSD is deeply integrated into BenPay Card, BenPay Merchant, and other applications for daily payments, cross-border settlement, and merchant services—enabling genuine “stablecoin spending.”

- Other Financial Applications: As a core asset of the BenFen ecosystem, BUSD can be used in lending, liquidity pools, and more key use cases, forming a stable capital foundation.

Across areas such as RWA on-chain integration, privacy payments, and multi-chain bridging, BUSD serves as the value backbone—evolving from a “stablecoin” into an “ecosystem token” essential to the BenFen economic system.

V. Conclusion

This foundational design ensures every transaction within the ecosystem is traceable and verifiable, providing a stable valuation and settlement layer for all applications built on BenFen—whether payments, DeFi, RWA, or privacy-focused interactions.

As the BenFen chain continues upgrading and expanding its application ecosystem, BUSD is transforming from a “system base currency” into the “financial hub” of the entire network.

- On-chain, BUSD is the clearing and settlement core for all smart contracts and economic models.

- Off-chain, BUSD represents a conversion channel between user assets and real-world value.

Through BUSD, BenFen achieves profound system coherence, sustainability, and a true decentralized economic closed loop—where every unit of on-chain value can be safely stored, efficiently utilized, and ultimately contribute to the long-term growth of the ecosystem.