Introduction

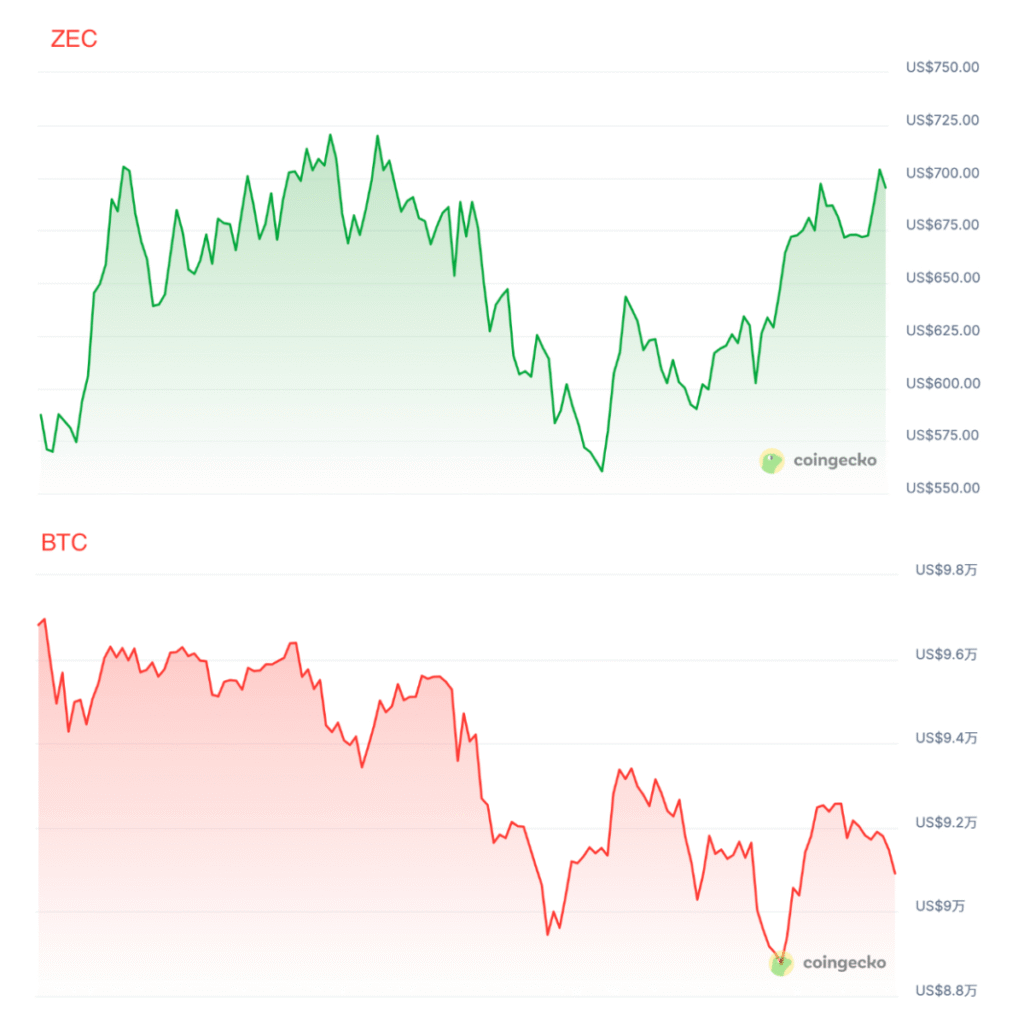

The crypto sector experienced significant volatility during a sharp short-term downturn, with BTC briefly falling below $86,000, driving the overall market capitalization down to $3.042 trillion. Amid this situation, the privacy sector unexpectedly emerged as a bright spot—ZEC once again defied the trend, surging past $700 during the session and demonstrating sustained strength relative to BTC, starkly contrasting with most altcoins. This counter-trend performance of ZEC has not only ignited market enthusiasm for privacy technology but also suggests that the privacy sector could see a collective breakout when market conditions improve, potentially even becoming the narrative driver for the next cycle.

Against this backdrop, beyond the community’s most popular ZEC, which other players in the privacy sector deserve attention? Which projects have breakout growth potential? The following analysis provides a detailed breakdown across three perspectives: token-launched projects, tokenless projects, and the native privacy public chain BenFen.

I. Token-Launched Projects

Token-Launched Projects: From established to emerging, capturing the dual opportunities of rebound and breakout. Privacy sector projects with issued tokens can be divided into established coins and low-market-cap areas. Established coins often have concentrated holdings and are highly elastic – once sector sentiment heats up, they are prone to short-term surges. The low-market-cap area mostly consists of relatively new coins that have greater potential after capital inflow.

Established Privacy Coins: A Solid Foundation & Potential for Volatility

Established projects maintain steady technological iterations and high community loyalty. Once ZEC drives sector sentiment, these coins are prone to short-term breakouts due to low selling pressure from distributed holdings.

- Oasis Network (ROSE): Launched in 2018, Oasis Network is a Layer 1 platform specializing in privacy-preserving computation. It achieves data confidentiality and scalability through its ParaTime architecture. Its token, ROSE, is used for governance and staking, and is currently priced around $0.12, with a market cap exceeding $1 billion. By 2025, Oasis’s privacy-focused innovative contract capabilities will have gained significant traction among DeFi developers, particularly in AI data protection scenarios. It presents itself as a suitable medium- to long-term satellite allocation alongside ZEC.

- Secret Network (SCRT): Launched in 2020 (though its technical roots trace back to earlier zero-knowledge research), this “privacy-by-default” Cosmos SDK chain enables confidential smart contracts. Its SCRT token is currently trading around $0.45, with a market capitalization of approximately $120 million. Secret Network demonstrates robust cross-chain privacy bridging capabilities and has recently deepened its integration within the Cosmos ecosystem, maintaining high community engagement. Amid tightening regulatory scrutiny, its optional transparency feature positions it favorably for institutional adoption.

- Horizen (ZEN): A blockchain platform focused on developer tools; its main chain implements optional privacy via zk-SNARKs, while supporting sidechains for building private DApps. Driven by the dual engines of privacy and scalability, ZEN has recently been the subject of frequent financing rumors, potentially positioning it to follow ZEC’s market trend.

- Beam (BEAM): Launched in 2019 and utilizing the Mimblewimble protocol, BEAM features a lightweight privacy design while supporting audit-friendly anonymity. Currently priced around $0.015 with a market capitalization of approximately $320 million, BEAM’s Lelantus-MW upgrade has enhanced its scalability and mobile compatibility, positioning it as a potential under-the-radar rebound candidate during ZEC’s market movement.

These established privacy coins share common characteristics: high technical barriers yet mature ecosystems, along with strong regulatory adaptability. If the privacy narrative regains traction, priority should be given to monitoring the strong signals of their ZEC/BTC trading pairs.

Low-Market-Cap Privacy Projects: Compelling Narratives + Newly-Launched Token Premium

- Anoma (XAN):Combining the centralized intent narrative with privacy protection, this represents a highly directional sector. With a market capitalization under $100 million and a recent listing, it demonstrates early-stage potential.

- Manta Pacific (MANTA) Low Market-Cap Ecosystem Sub-Project: As Manta continues to advance in on-chain privacy computing, the newly-launched tokens within its ecosystem (such as specific tool protocols and lightweight privacy component solutions) generally maintain market capitalizations below $100 million. These projects feature clear narratives and carry expectations of “ecosystem support.”

- Shade Protocol (SHD): Built on Secret Network, this privacy-focused DeFi protocol combines the dual narratives of “private stablecoins and private DeFi.” While its liquidity remains limited, it carries distinct speculative appeal and is well-positioned to benefit from sector rotation trends.

- Panther Protocol (ZKP): Specializing in cross-chain private assets and zk-proof relays, its product line markets itself as an institutional-grade privacy infrastructure. With modest market capitalization yet intense narrative purity, the project remains in its phased implementation stage.

The low-market-cap privacy sector continues to gain attention amid growing sentiment around private assets. Projects with clear narratives, light liquidity, and new-token premiums remain the most accessible targets for capital deployment. Overall, such lightly capitalized, narratively distinct, and early-stage privacy projects tend to exhibit the strongest emotional elasticity and trading opportunities during sector upswings.

II. Tokenless Projects: Airdrop Farming Strategies for Capturing Early Opportunities

Tokenless projects are predominantly L1 privacy chains with robust funding and active testnets. By participating in community tasks and testnet interactions, users can establish early-stage identities to position themselves for potential token airdrops.

Zama: A “Heavyweight Player” at the Intersection of AI, Blockchain, and Privacy

Zama is recognized as one of the most promising projects in the privacy sector with “multi-line narrative” potential. Its scope spans zero-knowledge proof (ZKP) privacy, encrypted AI inference, and data privacy solutions for finance, healthcare, and government sectors. The team has secured a total of $130 million across two funding rounds, backed by heavyweight institutions including Multicoin, Protocol Labs, and Pantera – a scale exceptionally rare among comparable projects.

As privacy capabilities increasingly become a consensus requirement for Web3 infrastructure, Zama’s positioning aligns perfectly with this trend – offering universal privacy modules that can directly serve AI applications, Layer 1 chains, and application layers.

The current primary participation method focuses on Guild newcomer tasks, characterized by low barriers to entry and extended cycles, making it suitable for long-term airdrop portfolio allocation.

Seismic: A TEE-Powered Privacy L1 Repeatedly Backed by a16z

Seismic represents the “hardware approach” among privacy blockchains, utilizing Intel TDX to construct a TEE (Trusted Execution Environment) and achieving protocol-level encryption through hardware isolation. While this approach differs from BenFen’s methodology of building native privacy capabilities on-chain, both ultimately reinforce the industry trend that “privacy is fundamental infrastructure.”

Seismic has secured two consecutive funding rounds totaling $17 million from a16z crypto this year, positioning it among the most prominently funded projects in the privacy L1 space. Currently in its developer testnet phase, participants can accumulate on-chain credentials by obtaining test tokens, deploying contracts, and earning community reputation through Discord engagement.

As private payments and privacy-focused assets gain tangible traction among end-users, foundational privacy Layer 1 networks like Seismic are poised to see their narratives gain corresponding momentum.

Inco: The FHE Sector’s Project Closest to Achieving “Fully Private Smart Contracts”

Inco leverages Fully Homomorphic Encryption (FHE) as its core technology, enabling direct execution of smart contract logic on encrypted data through its fhEVM. This breakthrough makes sophisticated applications like privacy-preserving gaming, dark pool trading, and Decentralized Identity (DID) feasible. Its technical approach is widely regarded as the “future-perfected” privacy computing solution, positioning it among the industry’s most advanced FHE implementations.

The project has secured nearly $10 million in funding with participation from a16z CSX, 1kx, and other prominent investors. Against the backdrop of private payments and privacy-focused DeFi rapidly expanding to consumer applications, FHE-based projects are poised to address heightened privacy demands, providing a “robust privacy computation layer” for future ecosystem applications.

Current interaction methods include obtaining test tokens on Base Sepolia, experiencing privacy-focused games, and completing Mint/Shield/Unshield processes. These low-barrier activities are particularly suitable for consistently building interaction records.

III. New Narrative Representative: BenFen’s “Usable Privacy Payments”

Among the watchlist in this round of privacy sector focus, one notable direction stands out—the shift from “technical privacy” to “consumer-perceivable and usable privacy.” BenFen, along with its application-layer gateway BenPay, is emerging as one of the few combinations that have successfully implemented consumer payment scenarios, representing a tangible implementation of privacy projects in practice.

BenFen: The Embodiment of Native Privacy L1 in Practical Application

Recently completed the V1.24.2 upgrade and Protocol 76, officially launching private payment functionality. Key technical features include:

- Leverages the secure execution environment of Move VM to further enhance on-chain privacy computing and transaction security.

- Implements MPC + TSS mechanisms to prevent private key exposure in plaintext and mitigate single points of failure.

- Integrates a high-performance consensus engine, consistently delivering seamless payment experiences with “second-level confirmation.”

Unlike most privacy-focused blockchains that remain conceptual, BenFen has already begun implementing practical on-chain payment scenarios.

BenPay: A Consumer-Facing Privacy Application Gateway with Tangible Usability

Users can now create a privacy wallet with a single click, freely transfer BUSD/BFC between standard and privacy wallets, and use the generated aBUSD and aBFC for confidential transactions. During daily operations such as payments, transfers, and savings, asset amounts and counterparty information remain fully concealed, delivering a tangible, usable on-chain privacy experience. This not only lowers the entry barrier for everyday users but also provides developers with open API interfaces to build customized privacy DApps. Looking ahead, as the BenFen ecosystem expands, BenPay is poised to become a critical bridge connecting Web2 and Web3 within the privacy sector, attracting more mainstream adoption and potentially amplifying the narrative impact of the entire field.

Its positioning differs from that of “privacy coins” like ZEC/XMR: BenFen’s privacy payment feature enables stablecoins to possess privacy capabilities while maintaining real-world usability. This type of tangible, functional privacy payment experience represents a previously missing component in the privacy sector, making BenFen’s privacy payment solution a significant emerging signal in this year’s privacy narrative.

IV. Conclusion

ZEC’s counter-trend surge has not only reshaped market expectations for the privacy sector but also highlighted its evolution from “anonymous speculation” toward “practical infrastructure.” BenFen chain and its ecosystem application BenPay exemplify this shift: through natively integrated privacy mechanisms, performance optimization, and compliance-ready interfaces, they are making private payments an everyday necessity—delivering “frictionless protection” for users and a scalable framework for developers. As ZEC drives momentum, the entire sector could see broad gains. Investors may balance exposure between established coins for stability and emerging projects for growth potential, monitoring capital flows and project developments. Privacy is evolving from a safe haven into a cornerstone of financial trust—meriting sustained attention.